If you’ve ever found yourself mindlessly scrolling through your phone at 1am, clicking “add to cart” on something you don’t really need (but definitely want), you might be engaging in what’s now called “doom spending”. This term, particularly relevant to Millennials and Gen Z, refers to using retail therapy as a way to self-soothe in uncertain times. But there’s more to it than just impulsive shopping – it’s often driven by a deeper, nagging fear that the future feels, well, doomed.

Read More: Debunking 5 Misconceptions About Cryptocurrencies

Why Is Doom Spending On the Rise?

Doom spending, in a nutshell, is buying things to cope with the stress of life. It’s like a sibling to “doomscrolling”, but instead of just scrolling through endless bad news, you’re hitting “buy” to numb that sense of impending doom. This concept has gained traction on social media, where people share their latest (often unnecessary) purchases while acknowledging the underlying anxiety fuelling their spending habits. For many, doom spending isn’t about finding joy – it’s about distraction.

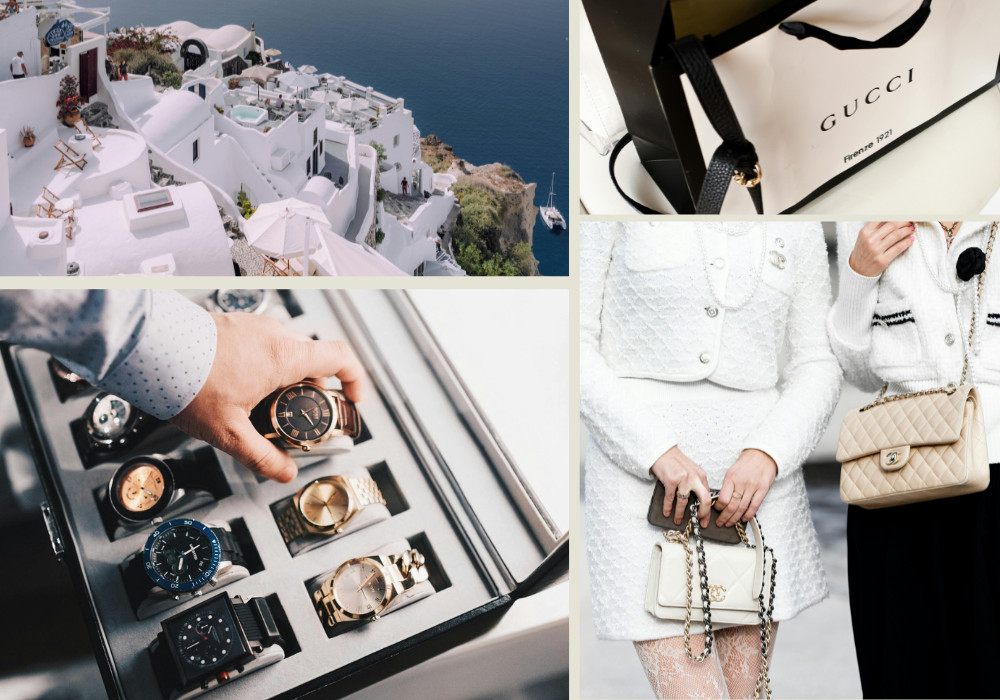

Whether it’s designer clothes, the latest tech gadget, or a spontaneous trip to a far-flung destination, these purchases provide a fleeting sense of control in a world that often feels out of control. It’s no surprise that doom spending has spiked among Millennials and Gen Z. Facing a tough economic landscape, staggering student loan debt, sky-high housing prices, and the daily reminders of a climate crisis, it’s easy to see why many turn to retail therapy as a brief escape from the chaos.

The Science Of Instant Gratification

Let’s be real – the economy isn’t exactly rolling out the red carpet for young people. Many feel like owning a home is an impossible dream, and saving for retirement feels like a cruel joke. So, instead of stashing money away for a future that seems out of reach, why not spend on the now? That’s the mindset of many doom spenders, even though they know, deep down, it’s not the smartest financial move. But why do we do it? Why blow hard-earned cash on things we don’t need when we know we should be saving? Doom spending taps into the idea that buying – especially nice things – gives us instant gratification. When we make a purchase, our brains release dopamine, the feel-good hormone that helps us temporarily forget our problems. It’s why retail therapy has always existed, but now the stakes feel even higher. The problem? The dopamine rush is short-lived, and soon enough, we’re back where we started – except now, our wallets are a little lighter.

The Pressure To Keep Up With Luxe Lifestyles

Unlike previous generations, many Millennials and Gen Z-ers feel like they’re falling behind financially. Studies like a 2020 report from the Federal Reserve indicate that Millennials are the first generation to be financially worse off than their parents, with Gen Z facing similar challenges. Homeownership feels like a distant dream, and even the basics – like renting an apartment or affording daily essentials – are out of reach for some. Having come of age during the 2008 financial crash, only to be hit by a global pandemic, the economic outlook for these generations feels grim. As a result, many young people feel there’s little point in saving for a future that seems so uncertain. Instead, they spend to capture small moments of happiness now, even if those moments are fleeting.

Then there’s the social media factor. Doom spending is amplified by our constant online presence, where influencers and ads relentlessly showcase all the shiny things we could be buying. It’s hard not to feel like you’re missing out when your Instagram feed is flooded with luxury purchases and spontaneous vacations. Add in the ease of “Buy Now, Pay Later” services, and impulsive spending becomes even more tempting. Worse still, it’s a vicious cycle – everyone’s trying to keep up. You buy something to match others, they buy something to match you, and soon, doom scrolling turns into doom spending, leaving you with a whole new wardrobe you didn’t really need – just because someone else bought one first.

How To Make Smarter Financial Decisions

The irony, of course, is that doom spending doesn’t actually make us feel better in the long run. Instead, it often leads to a vicious cycle of debt and regret. The guilt of overspending, coupled with the financial strain it causes, only worsens the stress and anxiety that led to the behaviour in the first place. It’s a downward spiral that leaves many feeling stuck, without a clear path to financial security.

So, how do we break the cycle of doom spending? Here are a few strategies to help:

- Create a Budget: It might sound boring, but knowing where your money is going can help curb those impulse purchases.

- Identify Your Triggers: Is it doomscrolling, work stress, or social media envy? Recognising what sparks your spending can help you avoid those situations.

- Take a Breather: If you’re feeling the urge to spend, give yourself 24 hours to think it over. Often, the impulse will pass.

- Find Alternative Coping Mechanisms: Instead of shopping, try going for a walk, meditating, or diving into a hobby that doesn’t involve spending.

Next time you’re about to hit “buy now”, take a deep breath and ask yourself: Is this something I really need, or am I just trying to fill a void? The future may be uncertain, but your financial health doesn’t have to be.

Catherine Pun

A Hong Kong native with Filipino-Chinese roots, Catherine infuses every part of her life with zest, whether she’s belting out karaoke tunes or exploring off-the-beaten-path destinations. Her downtime often includes unwinding with Netflix and indulging in a 10-step skincare routine. As the Editorial Director of Friday Club., Catherine brings her wealth of experience from major publishing houses, where she refined her craft and even authored a book. Her sharp editorial insight makes her a dynamic force, always on the lookout for the next compelling narrative.